Form 990: Difference between revisions

→History: disambig |

Sarah Reckhow |

||

| (38 intermediate revisions by 20 users not shown) | |||

| Line 1: | Line 1: | ||

{{update|date=May 2024|talksection=Update article (May 2024)}} |

|||

[[File:2017 Form 990-EZ.pdf|thumb|right|Form 990-EZ, 2017]] |

|||

{{Short description|United States Internal Revenue Service form}} |

|||

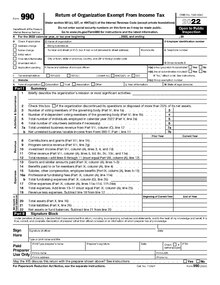

[[File:IRS Form 990 2022.pdf|thumb|alt=First page of Form 990|2022 revision of Form 990]] |

|||

'''Form 990''' (officially, the "Return of Organization Exempt From Income Tax"<ref name="actual_990">{{cite web |url=https://www.irs.gov/pub/irs-pdf/f990.pdf |title=Return of Organization Exempt From Income Tax | |

'''Form 990''' (officially, the "'''Return of Organization Exempt From Income Tax'''"<ref name="actual_990">{{cite web |url=https://www.irs.gov/pub/irs-pdf/f990.pdf |title=Return of Organization Exempt From Income Tax |access-date=January 28, 2016 |publisher=Internal Revenue Service}}</ref>) is a United States [[IRS tax forms|Internal Revenue Service (IRS) form]] that provides the public with information about a [[nonprofit organization]].<ref>{{Cite web |date=2016-12-01 |title=Telling the not-for-profit story through Form 990 |url=https://www.journalofaccountancy.com/issues/2016/dec/irs-form-990-for-not-for-profits.html |access-date=2023-12-09 |website=Journal of Accountancy}}</ref> It is also used by government agencies to prevent organizations from abusing their tax-exempt status.<ref>{{Cite book |url=https://www.oecd.org/tax/exchange-of-tax-information/42232037.pdf |title=Report on Abuse of Charities for Money-Laundering and Tax Evasion |publisher=OECD Centre for Tax Policy and Administration}}</ref> Some nonprofits, such as hospitals and other healthcare organizations, have more comprehensive reporting requirements. |

||

==Variants== |

==Variants== |

||

===Form 990-EZ=== |

===Form 990-EZ=== |

||

A variant of Form 990 called Form 990-EZ ("Short Form Return of Organization Exempt From Income Tax") can, with some exceptions, be used instead of Form 990 by organizations with gross receipts less than $200,000 and total assets less than $500,000.<ref name="i990ez">{{cite web |url=https://www.irs.gov/pub/irs-pdf/i990ez.pdf |title=Instructions for Form 990-EZ |access-date=February 3, 2016 |date=2015 |publisher=Internal Revenue Service}}</ref> |

|||

===Form 990-N=== |

===Form 990-N=== |

||

Small organizations whose annual gross receipts are "normally $50,000 or less" |

Small organizations whose annual gross receipts are "normally $50,000 or less" may file the electronic Form 990-N (officially, "Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not Required to File Form 990 or Form 990EZ") instead of the Form 990. There is no paper form for 990-N; organizations wishing to make a paper filing may complete the Form 990 or Form 990-EZ.<ref name="epost_irs">{{cite web |url=https://www.irs.gov/Charities-%26-Non-Profits/Annual-Electronic-Filing-Requirement-for-Small-Exempt-Organizations-Form-990-N-e-Postcard |title=Annual Electronic Filing Requirement for Small Exempt Organizations — Form 990-N (e-Postcard) |access-date=February 2, 2016 |publisher=Internal Revenue Service}}</ref> |

||

===Form 990-PF=== |

===Form 990-PF=== |

||

Form 990-PF is filed by private foundations in the US. It includes fiscal information and a complete list of grants. The form is due to the IRS 15th day of the 5th month after the end of the foundation's [[fiscal year]].<ref name="foundationcenter">{{cite web |url=http://foundationcenter.org/getstarted/tutorials/demystify/ |title=Demystifying the 990-PF |access-date=February 3, 2016 |publisher=Foundation Center}}</ref> |

|||

==Schedules== |

|||

In addition to Form 990, tax-exempt organizations are also subject to a variety of disclosure and compliance requirements through various schedules which are attached to Form 990 (and, in some cases, 990-EZ or 990-PF). Filing of schedules by organizations supplements, enhances, and further clarifies disclosures and compliance reporting made in Form 990. Often, filing of schedules is mandatory, but there are situations where organizations not otherwise subject to filing requirements may consider completing certain schedules despite not being technically obligated to. |

|||

{| class="wikitable" |

|||

|- |

|||

! Type !! Name !! Number of pages<ref name="allison" /> !! Can be filed with Form 990-EZ?<ref name="allison" /> |

|||

|- |

|||

| Schedule A |

|||

| Public Charity Status and Public Support |

|||

| 4 |

|||

| Yes |

|||

|- |

|||

| Schedule B |

|||

| Schedule of Contributors |

|||

| 8 |

|||

| Yes |

|||

|- |

|||

| Schedule C |

|||

| Political Campaign and Lobbying Activities |

|||

| 4 |

|||

| Yes |

|||

|- |

|||

| Schedule D |

|||

| Supplemental Financial Statements |

|||

| 5 |

|||

| No |

|||

|- |

|||

| Schedule E |

|||

| Schools |

|||

| 1 |

|||

| Yes |

|||

|- |

|||

| Schedule F |

|||

| Statement of Activities Outside the United States |

|||

| 4 |

|||

| No |

|||

|- |

|||

| Schedule G |

|||

| Supplemental Information Regarding Fundraising or Gaming Activities |

|||

| 3 |

|||

| Yes |

|||

|- |

|||

| Schedule H |

|||

| Hospitals |

|||

| 4 |

|||

| No |

|||

|- |

|||

| Schedule I |

|||

| Grants and Other Assistance to Organizations, Governments, and Individuals in the United States |

|||

| 2 |

|||

| No |

|||

|- |

|||

| Schedule J |

|||

| Compensation Information |

|||

| 3 |

|||

| No |

|||

|- |

|||

| Schedule K |

|||

| Supplemental Information on Tax-Exempt Bonds |

|||

| 2 |

|||

| No |

|||

|- |

|||

| Schedule L |

|||

| Transactions With Interested Persons |

|||

| 1 |

|||

| Yes |

|||

|- |

|||

| Schedule M |

|||

| Noncash Contributions |

|||

| 2 |

|||

| No |

|||

|- |

|||

| Schedule N |

|||

| Liquidation, Termination, Dissolution, or Significant Disposition of Assets |

|||

| 3 |

|||

| Yes |

|||

|- |

|||

| Schedule O |

|||

| Supplemental Information to Form 990 |

|||

| 2 |

|||

| No |

|||

|- |

|||

| Schedule R |

|||

| Related Organizations and Unrelated Partnerships |

|||

| 4 |

|||

| No |

|||

|} |

|||

==Filing requirements== |

==Filing requirements== |

||

Form 990 is due on the 15th of the |

Form 990 is due on the 15th of the fifth month after the organization's fiscal year ends, with the option for a single six-month extension.<ref>{{cite web|url=https://labyrinthinc.com/charity-resources/nonprofit-resources/irs-990-faqs |title=Annual exempt organization return: Due date |publisher=Labyrinth |access-date=2021-01-19}}</ref> |

||

The Form 990 disclosures do not require but strongly encourage nonprofit boards to adopt a variety of board policies regarding governance practices. These suggestions go beyond [[Sarbanes-Oxley]] requirements for nonprofits to adopt [[whistleblower]] and document retention policies. The IRS has indicated |

The Form 990 disclosures do not require but strongly encourage nonprofit boards to adopt a variety of board policies regarding governance practices. These suggestions go beyond [[Sarbanes-Oxley]] requirements for nonprofits to adopt [[whistleblower]] and document retention policies. The IRS has indicated it will use the Form 990 as an enforcement tool, particularly regarding executive compensation. For example, nonprofits that adopt specific procedures regarding executive compensation have a [[safe harbor (law)|safe harbor]] from excessive-compensation rules under section 4958 of the Internal Revenue Code and Treasury Regulation section 53.4958-6.<ref>{{cite web|last=IRS |url=https://www.irs.gov/pub/irs-tege/governance_practices.pdf |title=Governance and Related Topics - 501(c)(3) Organizations |publisher=Online.irs.gov |date=2008-02-04 |access-date=2009-06-05}}</ref> |

||

===Fiduciary reporting=== |

===Fiduciary reporting=== |

||

According to section 1223(b) of the [[Pension Protection Act of 2006]], a nonprofit organization that does not file annual returns or notices for three consecutive years will have its tax-exempt status revoked as of the due date of the third return or notice.<ref>{{cite web |title= Pension Protection Act of 2006, Section 1223(b) |date= August 17, 2006 |work= Government Printing Office |url= http://www.gpo.gov/fdsys/pkg/PLAW-109publ280/html/PLAW-109publ280.htm }}</ref> An organization's tax-exempt status may be reinstated if it can show reasonable cause for the years of |

According to section 1223(b) of the [[Pension Protection Act of 2006]], a nonprofit organization that does not file annual returns or notices for three consecutive years will have its tax-exempt status revoked as of the due date of the third return or notice.<ref>{{cite web |title= Pension Protection Act of 2006, Section 1223(b) |date= August 17, 2006 |work= Government Printing Office |url= http://www.gpo.gov/fdsys/pkg/PLAW-109publ280/html/PLAW-109publ280.htm }}</ref> An organization's tax-exempt status may be reinstated if it can show reasonable cause for the years of not filing.<ref>{{cite web |title= Notice 2011-43: Transitional Relief Under Internal Revenue Code § 6033(j) for Small Organizations |work= Internal Revenue Bulletin: 2011-25 |publisher= Internal Revenue Service |date= June 20, 2011 |url= https://www.irs.gov/irb/2011-25_IRB/ar09.html }}</ref> |

||

===Who must file?=== |

===Who must file?=== |

||

Form 990 is required to be filed by most tax-exempt organizations under section 501(a). This includes organizations described by any of the subsections of Internal Revenue Code Section [[501(c)]], [[501(d) organization|501(d) apostolic organizations]], 501(e) cooperative hospital service organization, 501(f) cooperative service organizations of schools, 501(j) amateur sports organizations, 501(k) child care organizations, 501(n) charitable risk pools, and 4947(a)(1) nonexempt charitable trusts. Organizations described by any of these sections must file Form 990 even if the organization has not applied for a determination letter from the Internal Revenue Service.<ref name= i990>"[https://www.irs.gov/pub/irs-pdf/i990.pdf Form 990 Instructions]". ''Internal Revenue Service''. 2018. Retrieved July 19, 2018.</ref> |

Form 990 is required to be filed by most tax-exempt organizations under section 501(a). This includes organizations described by any of the subsections of Internal Revenue Code Section [[501(c)]], [[501(d) organization|501(d) apostolic organizations]], 501(e) cooperative hospital service organization, 501(f) cooperative service organizations of schools, 501(j) amateur sports organizations, 501(k) child care organizations, 501(n) charitable risk pools, and 4947(a)(1) nonexempt charitable trusts. Organizations described by any of these sections must file Form 990 even if the organization has not applied for a determination letter from the Internal Revenue Service.<ref name= i990>"[https://www.irs.gov/pub/irs-pdf/i990.pdf Form 990 Instructions]". ''Internal Revenue Service''. 2018. Retrieved July 19, 2018.</ref> |

||

A tax-exempt organization with annual gross receipts of less than $200,000 and assets less than $500,000 has the option of |

A tax-exempt organization with annual gross receipts of less than $200,000 and assets less than $500,000 has the option of filing a shorter alternative form, Form 990-EZ instead.<ref name= i990/><ref name="allison">Grace Allison. "The New Form 990 for Tax-Exempt Organizations: Revolution in Progress". 2010. ''Estate planning''. 37(3). p. 14–20.</ref> |

||

For a tax-exempt organization that normally has gross receipts no more than $50,000 per year, the organization has the option to file a shorter alternative form, Form 990-N instead.<ref name= i990/> |

For a tax-exempt organization that normally has gross receipts no more than $50,000 per year, the organization has the option to file a shorter alternative form, Form 990-N instead.<ref name= i990/> |

||

| Line 120: | Line 34: | ||

===Filing modalities=== |

===Filing modalities=== |

||

The Form 990 may be filed with the IRS by mail or electronically with an authorized [[IRS e-file]] provider, for all fiscal years that began before July 1, 2019. In accordance with the Taxpayer First Act of 2019, the Form 990 must be filed electronically, not by mail, for all fiscal years beginning on or after July 1, 2019.<ref>"[https://www.congress.gov/116/bills/hr3151/BILLS-116hr3151enr.pdf Taxpayer First Act of 2019]". ''United States Congress''. July 1, 2019.</ref><ref>Constantine, George; Lewin, Cindy; Steinberg, Andrew (July 2, 2019). "IRS Reform Law Expands Mandatory Electronic Filing of Nonprofit Tax Returns". ''[[Venable LLP]]''.</ref> |

The Form 990 may be filed with the IRS by mail or electronically with an authorized [[IRS e-file]] provider, for all fiscal years that began before July 1, 2019. In accordance with the Taxpayer First Act of 2019, the Form 990 must be filed electronically, not by mail, for all fiscal years beginning on or after July 1, 2019.<ref>"[https://www.congress.gov/116/bills/hr3151/BILLS-116hr3151enr.pdf Taxpayer First Act of 2019]". ''United States Congress''. July 1, 2019.</ref><ref>Constantine, George; Lewin, Cindy; Steinberg, Andrew (July 2, 2019). "IRS Reform Law Expands Mandatory Electronic Filing of Nonprofit Tax Returns". ''[[Venable LLP]]''.</ref> |

||

Transition of Form 990-EZ: For tax years ending July 31, 2021, and later, Forms 990-EZ must be filed electronically. <ref>"[https://www.irs.gov/e-file-providers/e-file-for-charities-and-non-profits/ irs.gov ]". ''IRS.gov''. pulled May, 17, 2022.</ref> |

|||

==Penalties== |

==Penalties== |

||

There is a penalty of $20 per day that |

There is a penalty of $20 per day that an organization fails to make its Forms 990 publicly available. The penalty is capped at a maximum of $10,000 for any single failure. Any person who willfully fails to comply will be subject to an additional penalty of $5,000.<ref>{{cite web|url=https://www.irs.gov/charities-non-profits/political-organizations/political-organization-filing-requirements-penalties-for-failing-to-make-forms-990-publicly-available |title=Penalties for Failing to Make Forms 990 Publicly Available |publisher=IRS |access-date=2017-12-07}}</ref> There are other penalties for, e.g., omitting information.<ref name="eotopicg02" />{{rp|229}} |

||

In 1998, over $10 million was collected by the IRS for penalties on over 9000 forms.<ref name="eotopicg02" />{{rp|229}} |

In 1998, over $10 million was collected by the IRS for penalties on over 9000 forms.<ref name="eotopicg02" />{{rp|229}} |

||

| Line 130: | Line 46: | ||

=== Form 990 data published by IRS === |

=== Form 990 data published by IRS === |

||

The IRS publishes Form 990 data in |

The IRS publishes Form 990 data in three main forms. Two are part of the [[Statistics of Income]] program: |

||

* An annual extract of tax-exempt organizational data, which covers selected financial data from filters of Form 990, 990-EZ, and 990-PF, with data available from calendar year 2012 to the most recent year for which filing and statistics compilation is complete.<ref name=irs-stats-dataset>{{cite web|url = https://www.irs.gov/statistics/soi-tax-stats-annual-extract-of-tax-exempt-organization-financial-data|title = SOI Tax Stats - Annual Extract of Tax-Exempt Organization Financial Data| |

* The IRS Tax Exempt Organization Search page offers summary information about nonprofits, as well as copies of their tax returns.<ref>{{cite web |url=https://apps.irs.gov/app/eos/ |title=Tax Exempt Organization Search |publisher=[[Internal Revenue Service]] |access-date=2024-08-30}}</ref> |

||

* An annual extract of tax-exempt organizational data, which covers selected financial data from filters of Form 990, 990-EZ, and 990-PF, with data available from calendar year 2012 to the most recent year for which filing and statistics compilation is complete.<ref name=irs-stats-dataset>{{cite web|url = https://www.irs.gov/statistics/soi-tax-stats-annual-extract-of-tax-exempt-organization-financial-data|title = SOI Tax Stats - Annual Extract of Tax-Exempt Organization Financial Data|access-date = October 14, 2017|publisher = [[Internal Revenue Service]]}}</ref> This is also available as a public dataset on Google [[BigQuery]].<ref name=bigquery>{{cite web|url = https://cloud.google.com/bigquery/public-data/irs-990|title = IRS Form 990 Data|publisher = [[BigQuery]]|access-date = October 14, 2017}}</ref> |

|||

* As a public dataset on [[Amazon S3]], hosted in the US East region. The dataset includes index files for each year that list nonprofits that filed Form 990 in that year (possibly for a previous year) along with the identifier for their filing. This identifier can be used to fetch their filed Form 990 as |

* As a public dataset on [[Amazon S3]], hosted in the US East region. The dataset includes index files for each year that list nonprofits that filed Form 990 in that year (possibly for a previous year) along with the identifier for their filing. This identifier can be used to fetch their filed Form 990 as an XML file. Data covers returns filed from 2011 to the present and is regularly updated.<ref name=irs-filings-dataset>{{cite web|url = https://aws.amazon.com/public-datasets/irs-990/|title = IRS 990 Filings on AWS|access-date = October 14, 2017}}</ref> This dataset is used by Charity Navigator.<ref name=charity-navigator>{{cite web|url = http://990.charitynavigator.org/|title = 990 Decoder -- Charity Navigator. ETL toolkit for 2.5 million electronic nonprofit tax returns released by the IRS.|publisher = Charity Navigator|access-date = October 14, 2017}}</ref> |

||

=== Third-party sources of Form 990 === |

=== Third-party sources of Form 990 === |

||

* Google [[BigQuery]], which has IRS Form 990 data as a public dataset.<ref name=bigquery/> This is based on statistics published by the IRS from 2012 to the most recent completed year.<ref name=irs-stats-dataset/> |

* Google [[BigQuery]], which has IRS Form 990 data as a public dataset.<ref name=bigquery/> This is based on statistics published by the IRS from 2012 to the most recent completed year.<ref name=irs-stats-dataset/> |

||

* [[Charity Navigator]], which maintains a "990 Decoder" website with over 2.5 million tax returns.<ref name=charity-navigator/><ref name=cn-990-decoder-launch/> This is based on forms filed from 2011 to the present, and uploaded by the IRS to [[Amazon S3]].<ref name=irs-filings-dataset/> |

* [[Charity Navigator]], which maintains a "990 Decoder" website with over 2.5 million tax returns.<ref name=charity-navigator/><ref name=cn-990-decoder-launch/> This is based on forms filed from 2011 to the present, and uploaded by the IRS to [[Amazon S3]].<ref name=irs-filings-dataset/> |

||

* |

* Economic Research Institute<ref>{{cite web|url=https://www.erieri.com/form990finder |title=Nonprofit Organization Information | publisher=Economic Research Institute|access-date=2014-05-17}}</ref> provides PDF copies of annual returns, signatures not blacked out. |

||

* |

* Foundation Center<ref>{{cite web|url=http://tfcny.fdncenter.org/990s/990search/esearch.php |title=Foundation Center - 990 Finder |access-date=2011-08-21 |url-status=dead |archive-url=https://web.archive.org/web/20130523043941/http://tfcny.fdncenter.org/990s/990search/esearch.php |archive-date=2013-05-23 }}</ref> IRS Form 990 lookup tool; provides PDF copies of annual returns, signatures blacked out. |

||

* |

* Guidestar<ref>{{cite web|url=http://www.guidestar.org/ |title=guidestar.org | publisher=guidestar.org |date=2014-03-06 |access-date=2014-04-23}}</ref> IRS Form 990's and other information for selection of nonprofits, free and fee based |

||

* |

* NCCS<ref>{{cite web|url=http://nccs.urban.org/ |title=nccs.urban.org | publisher=nccs.urban.org |date=2008-07-15 |access-date=2014-04-23}}</ref> IRS Form 990 search tool and nonprofit organization profiles, signatures blacked out. |

||

* [[BoardSource]] Governance requirements<ref>{{cite web |url=http://www.boardsource.org/dl.asp?document_id=681 |title=Learning Center and Store |publisher=BoardSource |access-date=2014-03-17 |url-status=dead |archive-url=https://web.archive.org/web/20120219044314/http://www.boardsource.org/dl.asp?document_id=681 |archive-date=2012-02-19 }}</ref> in 990. |

|||

* NCCS<ref>{{cite web|url=http://nccs.urban.org/ |title=nccs.urban.org | publisher=nccs.urban.org |date=2008-07-15 |accessdate=2014-04-23}}</ref> IRS Form 990 search tool and nonprofit organization profiles, signatures blacked out. |

|||

* Before shutting down in September 2022,<ref>{{Cite web |last=Suozzo |first=Andrea |date=2022-12-22 |title=The IRS Hasn't Released Nearly Half a Million Nonprofit Tax Records |url=https://www.propublica.org/article/irs-hasnt-released-nearly-half-million-nonprofit-tax-records |access-date=2024-05-15 |website=ProPublica |language=en}}</ref> Open990<ref>{{cite web |title=Research people or nonprofits |url=https://www.open990.org/org/ |url-status=dead |archive-url=https://web.archive.org/web/20220904224848/https://www.open990.org/org/ |archive-date=2022-09-04 |access-date= |publisher=Open990}}</ref> distributed [[Time series|timeseries]] data reports on compensation and financial indicators using [[Fuzzy matching (computer-assisted translation)|fuzzy matching]] against the AWS [[dataset]]. |

|||

* [[BoardSource]] Governance requirements<ref>{{cite web |url=http://www.boardsource.org/dl.asp?document_id=681 |title=Learning Center and Store |publisher=BoardSource |date= |accessdate=2014-03-17 |deadurl=yes |archiveurl=https://web.archive.org/web/20120219044314/http://www.boardsource.org/dl.asp?document_id=681 |archivedate=2012-02-19 |df= }}</ref> in 990. |

|||

* |

* The for-profit company Citizen Audit<ref>{{cite web|url=http://citizenaudit.org |title=Nonprofit Form 990 Search | publisher=Citizen Audit |access-date=2014-05-18}}</ref> provides PDF copies of annual returns, signatures not blacked out, and full-text searches of 990 forms, but only if you sign up for their services at $350 per year. |

||

* [[ProPublica]]'s Nonprofit Explorer<ref>{{cite web |title=Nonprofit Explorer |url=https://projects.propublica.org/nonprofits/ |publisher=[[ProPublica]] | |

* [[ProPublica]]'s Nonprofit Explorer<ref>{{cite web |title=Nonprofit Explorer |date=9 May 2013 |url=https://projects.propublica.org/nonprofits/ |publisher=[[ProPublica]] |access-date=2018-10-18}}</ref> allows search by an organization's name, a keyword, or city as well as by reported officers or employees. Summary data and full PDFs are freely available for download; no registration required. |

||

==History== |

==History== |

||

| Line 154: | Line 72: | ||

In 1969, Congress passed a law requiring the reporting of the compensation paid to officers by [[501(c)(3) organization]]s.<ref name="eotopicg02" /><ref>"[https://www.law.cornell.edu/uscode/text/26/6033 Internal Revenue Code Section 6033(b)]". ''Internal Revenue Service''. Legal Information Institute. Cornell University.</ref> The IRS extended this requirement to all other tax-exempt organizations.<ref name="eotopicg02" /><ref>"[https://www.law.cornell.edu/cfr/text/26/1.6033-2 Treas. Reg. 1.6033-2(a)(2)(ii)(g)]. ''Internal Revenue Service''. Legal Information Institute. Cornell University.</ref> |

In 1969, Congress passed a law requiring the reporting of the compensation paid to officers by [[501(c)(3) organization]]s.<ref name="eotopicg02" /><ref>"[https://www.law.cornell.edu/uscode/text/26/6033 Internal Revenue Code Section 6033(b)]". ''Internal Revenue Service''. Legal Information Institute. Cornell University.</ref> The IRS extended this requirement to all other tax-exempt organizations.<ref name="eotopicg02" /><ref>"[https://www.law.cornell.edu/cfr/text/26/1.6033-2 Treas. Reg. 1.6033-2(a)(2)(ii)(g)]. ''Internal Revenue Service''. Legal Information Institute. Cornell University.</ref> |

||

In 1976, Form 990 was |

In 1976, Form 990 was 6 pages including instructions, with 8 pages for Schedule A.<ref name="eotopicg02" /> By 2000, Form 990 was six pages, Schedule A was six pages, Schedule B was at least 2 pages, and instructions were 42 pages.<ref name="eotopicg02" /> The increase in pages was due to use of a larger font size and the inclusion of sections that are only required for certain organizations.<ref name="eotopicg02" /> |

||

Starting in 2000, [[527 organization|political organization]]s were required to file Form 990.<ref name="eotopicg02" /> |

Starting in 2000, [[527 organization|political organization]]s were required to file Form 990.<ref name="eotopicg02" /> |

||

| Line 162: | Line 80: | ||

In 2010, the minimum threshold of when an organization is required to file Form 990 was increased; the minimum annual gross receipts was increased from $100,000 to $200,000 and the minimum assets was increased from $250,000 to $500,000.<ref name="allison"/> |

In 2010, the minimum threshold of when an organization is required to file Form 990 was increased; the minimum annual gross receipts was increased from $100,000 to $200,000 and the minimum assets was increased from $250,000 to $500,000.<ref name="allison"/> |

||

With the availability of the internet, access to the Form 990 of an organization has also become easier. Originally Form 990 had to be requested through the IRS. This was changed to allow access to the form directly through the organization, although in some cases organizations refused to provide access.<ref name="eotopicg02">{{cite web |url=https://www.irs.gov/pub/irs-tege/eotopicg02.pdf |title=G. Form 990 | |

With the availability of the internet, access to the Form 990 of an organization has also become easier. Originally Form 990 had to be requested through the IRS. This was changed to allow access to the form directly through the organization, although in some cases organizations refused to provide access.<ref name="eotopicg02">{{cite web |url=https://www.irs.gov/pub/irs-tege/eotopicg02.pdf |title=G. Form 990 |access-date=January 29, 2016 |date=2002 |first1=Cheryl |last1=Chasin |first2= Debra |last2= Kawecki |first3= David |last3= Jones |work=Internal Revenue Service |archive-url=https://web.archive.org/web/20150702072044/https://www.irs.gov/pub/irs-tege/eotopicg02.pdf |archive-date=July 2, 2015}}</ref> |

||

On July 16, 2018, the IRS announced that only [[501(c)(3)|501(c)(3) organizations]], [[charitable trusts|4947(a)(1) nonexempt charitable trust]]s, and [[private foundation|6033(d) nonexempt private foundation]]s are required to report the names and addresses of donors on Schedule B. All other tax-exempt organizations will be allowed to omit the names and addresses of donors when completing Schedule B, although they are still required to retain that information and report that information upon request by the IRS. The change in reporting requirements is effective with all tax years ending on or after December 31, 2018.<ref>"[https://www.irs.gov/pub/irs-drop/rp-18-38.pdf Revenue Procedure, Rev. Proc. 2018-13]". ''Internal Revenue Service''. July 16, 2018.</ref> The change does not affect reporting of donors by [[527 organization|527 political organization]]s.<ref>Wyland, Michael (July 18, 2018). "[https://nonprofitquarterly.org/2018/07/18/treasury-weakens-donor-disclosure-requirements-for-some-nonprofits/ Treasury Weakens Donor Disclosure Requirements for Some Nonprofits]". ''Nonprofit Quarterly''.</ref> The IRS said that the change in reporting was made in the discretion of the [[Commissioner of Internal Revenue]] who had determined that the IRS generally does not use the donors' information, and exclusion of this information from Schedule B would reduce the risk of accidentally releasing confidential information to the public while reducing the organizations' time and cost of preparing Form 990.<ref name= majorchange>Parks, Zachary G. (July 18, 2018). "[https://www.natlawreview.com/article/irs-announces-major-change-to-nonprofit-donor-disclosure-requirements IRS Announces Major Change To Nonprofit Donor Disclosure Requirements]". ''The National Law Review''.</ref> Some states continue to require disclosure of this information to state agencies.<ref name= majorchange/> The state of Montana and the state of New Jersey filed a lawsuit stating that the IRS had violated the [[Administrative Procedure Act (United States)|Administrative Procedure Act]] by waiving the donor disclosure requirements without allowing the public to comment on the new procedure. A federal judge agreed and reinstated the donor disclosure requirements.<ref>Lewin, Cynthia M.; Norton, Lawrence H. (August 1, 2019). "[https://www.politicallawbriefing.com/2019/08/donor-disclosure-rules-for-nonprofit-tax-returns-overturned-by-federal-court/ Donor Disclosure Rules for Nonprofit Tax Returns Overturned by Federal Court]". ''[[Venable LLP]]''.</ref> |

|||

On July 16, 2018, the IRS announced that only [[501(c)(3)|501(c)(3) organizations]], [[charitable trusts|4947(a)(1) nonexempt charitable trust]]s, and [[private foundation|6033(d) nonexempt private foundation]]s are required to report the names and addresses of donors on Schedule B. All other tax-exempt organizations will be allowed to omit the names and addresses of donors when completing Schedule B, although they are still required to retain that information and report that information upon request by the IRS. The change in reporting requirements is effective with all tax years ending on or after December 31, 2018.<ref>"[https://www.irs.gov/pub/irs-drop/rp-18-38.pdf Revenue Procedure, Rev. Proc. 2018-13]". ''Internal Revenue Service''. July 16, 2018.</ref> The change did not affect reporting of donors by [[527 organization|527 political organization]]s.<ref>Wyland, Michael (July 18, 2018). "[https://nonprofitquarterly.org/2018/07/18/treasury-weakens-donor-disclosure-requirements-for-some-nonprofits/ Treasury Weakens Donor Disclosure Requirements for Some Nonprofits]". ''Nonprofit Quarterly''.</ref> The IRS said that the change in reporting was made in the discretion of the [[Commissioner of Internal Revenue]] who had determined that the IRS generally does not use the donors' information, and exclusion of this information from Schedule B would reduce the risk of accidentally releasing confidential information to the public while reducing the organizations' time and cost of preparing Form 990.<ref name= majorchange>Parks, Zachary G. (July 18, 2018). "[https://www.natlawreview.com/article/irs-announces-major-change-to-nonprofit-donor-disclosure-requirements IRS Announces Major Change To Nonprofit Donor Disclosure Requirements]". ''The National Law Review''.</ref> Some states continue to require disclosure of this information to state agencies.<ref name= majorchange/> The state of Montana and the state of New Jersey filed a lawsuit stating that the IRS had violated the [[Administrative Procedure Act (United States)|Administrative Procedure Act]] by waiving the donor disclosure requirements without allowing the public to comment on the new procedure. A federal judge agreed and reinstated the donor disclosure requirements.<ref>Lewin, Cynthia M.; Norton, Lawrence H. (August 1, 2019). "[https://www.politicallawbriefing.com/2019/08/donor-disclosure-rules-for-nonprofit-tax-returns-overturned-by-federal-court/ Donor Disclosure Rules for Nonprofit Tax Returns Overturned by Federal Court]". ''[[Venable LLP]]''.</ref> On September 6, the IRS issued proposed regulations that would again suspend the requirement for affected organizations to disclose their donors on Schedule B and allow the public to comment on the new procedure in compliance with the Administrative Procedure Act.<ref>Norton, Lawrence H.; Lewin, Cynthia M. (September 11, 2019). "[https://www.venable.com/insights/publications/2019/09/irs-issues-proposed-regulations-on-nonprofit-donor IRS Issues Proposed Regulations on Nonprofit Donor Disclosure Rules]". ''[[Venable LLP]]''.</ref><ref name= irs2019-19501>"[https://www.govinfo.gov/content/pkg/FR-2019-09-10/pdf/2019-19501.pdf Proposed Reg. 102508–16: Guidance Under Section 6033 Regarding the Reporting Requirements of Exempt Organizations]". ''Internal Revenue Service''. Federal Register. Vol. 84. No. 175. p. 47447–47454. December 10, 2019.</ref> The IRS may finalize the proposed regulations on or after December 9, 2019.<ref name= irs2019-19501/> |

|||

==Use for charity evaluation research== |

==Use for charity evaluation research== |

||

[[Charity Navigator]] uses IRS Forms 990<ref>{{cite web|url=http://www.charitynavigator.org/index.cfm/bay/content.view/cpid/484.htm#10 |title=FAQ for Donors |publisher=Charity Navigator |date |

[[Charity Navigator]] uses IRS Forms 990<ref>{{cite web|url=http://www.charitynavigator.org/index.cfm/bay/content.view/cpid/484.htm#10 |title=FAQ for Donors |publisher=Charity Navigator |access-date=2014-04-23}}</ref> to rate charities. In February 2017, Charity Navigator launched the Digitized Form 990 Decoder, a [[free and open-source software]] dataset and tools to analyze Form 990 filings. At launch, more than 900,000 forms had been processed.<ref name=cn-990-decoder-launch>{{cite web |url=https://www.charitynavigator.org/index.cfm?bay=content.view&cpid=4669 |title=Charity Navigator Publishes Software for Decoding Nonprofit Data |publisher=Charity Navigator |access-date=February 10, 2017 |date=February 3, 2017}}</ref><ref name=cn-990-decoder-open-source>{{cite web |url=http://blog.charitynavigator.org/2017/02/first-open-source-release-of-code-that.html#more |title=First Open Source Release of Code that Reads Digitized IRS Form 990 Data |access-date=February 10, 2017 |date=February 3, 2017 |website=Charity Navigator Blog |first= Sandra |last=Miniutti}}</ref> |

||

Meanwhile [[Holden Karnofsky]] of the nonprofit charity evaluator [[GiveWell]] has criticized Form 990 for not providing sufficient information about what a charity does or where it operates.<ref name="dont_talk_to_me">{{cite web |url=http://blog.givewell.org/2007/05/23/dont-talk-to-me-about-the-form-990/ |title= |

Meanwhile [[Holden Karnofsky]] of the nonprofit charity evaluator [[GiveWell]] has criticized Form 990 for not providing sufficient information about what a charity does or where it operates.<ref name="dont_talk_to_me">{{cite web |url=http://blog.givewell.org/2007/05/23/dont-talk-to-me-about-the-form-990/ |title=Don't talk to me about the Form 990 |access-date=January 28, 2016 |date=May 23, 2007 |last=Karnofsky |first=Holden |publisher=The GiveWell Blog}}</ref> However GiveWell does still use Form 990 to answer some questions when investigating charities.<ref name="guide_to_gw_fin_met">{{cite web |url=http://www.givewell.org/international/technical/criteria/financial-metrics |title=Guide to GiveWell's financial metrics |access-date=January 28, 2016 |publisher=GiveWell}}</ref> |

||

Data from Form 990 was used by Sarah Reckhow as an information source for her book ''Follow the Money: How Foundation Dollars Change Public School Politics''. Reckhow expressed concern about the lack of corresponding public data available if philanthropic funders moved away from nonprofits to LLCs such as the [[Chan Zuckerberg Initiative]].<ref>{{cite web|url = https://histphil.org/2017/01/26/philanthropic-data-and-the-rise-of-llcs-or-what-happens-when-scholars-can-no-longer-follow-the-money/|title = Philanthropic Data And The Rise Of LLCs; Or, What Happens When Scholars Can No Longer Follow The Money|last = Reckhow|first = Sarah|date = January 26, 2017| |

Data from Form 990 was used by political scientist [[Sarah Reckhow]] as an information source for her book ''Follow the Money: How Foundation Dollars Change Public School Politics''. Reckhow expressed concern about the lack of corresponding public data available if philanthropic funders moved away from nonprofits to LLCs such as the [[Chan Zuckerberg Initiative]].<ref>{{cite web|url = https://histphil.org/2017/01/26/philanthropic-data-and-the-rise-of-llcs-or-what-happens-when-scholars-can-no-longer-follow-the-money/|title = Philanthropic Data And The Rise Of LLCs; Or, What Happens When Scholars Can No Longer Follow The Money|last = Reckhow|first = Sarah|date = January 26, 2017|access-date = April 25, 2018|publisher = HistPhil}}</ref> |

||

There was a website called ''Quality 990'' that advocated for higher quality Form 990s.<ref name="q990">{{cite web |url=http://www.qual990.org/background.html |title=Background for Quality 990 Efforts | |

There was a website called ''Quality 990'' that advocated for higher quality Form 990s.<ref name="q990">{{cite web |url=http://www.qual990.org/background.html |title=Background for Quality 990 Efforts |access-date=January 29, 2016 |archive-url=https://web.archive.org/web/20080515232901/http://www.qual990.org/background.html |archive-date=May 15, 2008}}</ref> |

||

==See also== |

==See also== |

||

| Line 186: | Line 103: | ||

[[Category:IRS tax forms|0990]] |

[[Category:IRS tax forms|0990]] |

||

[[Category:Non-profit organizations based in the United States]] |

|||

Latest revision as of 01:19, 7 December 2024

This article needs to be updated. (May 2024) |

Form 990 (officially, the "Return of Organization Exempt From Income Tax"[1]) is a United States Internal Revenue Service (IRS) form that provides the public with information about a nonprofit organization.[2] It is also used by government agencies to prevent organizations from abusing their tax-exempt status.[3] Some nonprofits, such as hospitals and other healthcare organizations, have more comprehensive reporting requirements.

Variants

[edit]Form 990-EZ

[edit]A variant of Form 990 called Form 990-EZ ("Short Form Return of Organization Exempt From Income Tax") can, with some exceptions, be used instead of Form 990 by organizations with gross receipts less than $200,000 and total assets less than $500,000.[4]

Form 990-N

[edit]Small organizations whose annual gross receipts are "normally $50,000 or less" may file the electronic Form 990-N (officially, "Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not Required to File Form 990 or Form 990EZ") instead of the Form 990. There is no paper form for 990-N; organizations wishing to make a paper filing may complete the Form 990 or Form 990-EZ.[5]

Form 990-PF

[edit]Form 990-PF is filed by private foundations in the US. It includes fiscal information and a complete list of grants. The form is due to the IRS 15th day of the 5th month after the end of the foundation's fiscal year.[6]

Filing requirements

[edit]Form 990 is due on the 15th of the fifth month after the organization's fiscal year ends, with the option for a single six-month extension.[7]

The Form 990 disclosures do not require but strongly encourage nonprofit boards to adopt a variety of board policies regarding governance practices. These suggestions go beyond Sarbanes-Oxley requirements for nonprofits to adopt whistleblower and document retention policies. The IRS has indicated it will use the Form 990 as an enforcement tool, particularly regarding executive compensation. For example, nonprofits that adopt specific procedures regarding executive compensation have a safe harbor from excessive-compensation rules under section 4958 of the Internal Revenue Code and Treasury Regulation section 53.4958-6.[8]

Fiduciary reporting

[edit]According to section 1223(b) of the Pension Protection Act of 2006, a nonprofit organization that does not file annual returns or notices for three consecutive years will have its tax-exempt status revoked as of the due date of the third return or notice.[9] An organization's tax-exempt status may be reinstated if it can show reasonable cause for the years of not filing.[10]

Who must file?

[edit]Form 990 is required to be filed by most tax-exempt organizations under section 501(a). This includes organizations described by any of the subsections of Internal Revenue Code Section 501(c), 501(d) apostolic organizations, 501(e) cooperative hospital service organization, 501(f) cooperative service organizations of schools, 501(j) amateur sports organizations, 501(k) child care organizations, 501(n) charitable risk pools, and 4947(a)(1) nonexempt charitable trusts. Organizations described by any of these sections must file Form 990 even if the organization has not applied for a determination letter from the Internal Revenue Service.[11]

A tax-exempt organization with annual gross receipts of less than $200,000 and assets less than $500,000 has the option of filing a shorter alternative form, Form 990-EZ instead.[11][12]

For a tax-exempt organization that normally has gross receipts no more than $50,000 per year, the organization has the option to file a shorter alternative form, Form 990-N instead.[11]

Churches, including houses of worship such as synagogues and mosques, and their integrated auxiliaries, associations of churches, and any religious order that engages exclusively in religious activity are not required to file.[13] A school below college level affiliated with a church or operated by a religious order may be exempt from the requirement to file Form 990.[14]

Filing modalities

[edit]The Form 990 may be filed with the IRS by mail or electronically with an authorized IRS e-file provider, for all fiscal years that began before July 1, 2019. In accordance with the Taxpayer First Act of 2019, the Form 990 must be filed electronically, not by mail, for all fiscal years beginning on or after July 1, 2019.[15][16]

Transition of Form 990-EZ: For tax years ending July 31, 2021, and later, Forms 990-EZ must be filed electronically. [17]

Penalties

[edit]There is a penalty of $20 per day that an organization fails to make its Forms 990 publicly available. The penalty is capped at a maximum of $10,000 for any single failure. Any person who willfully fails to comply will be subject to an additional penalty of $5,000.[18] There are other penalties for, e.g., omitting information.[19]: 229

In 1998, over $10 million was collected by the IRS for penalties on over 9000 forms.[19]: 229

Public inspection regulations

[edit]Public Inspection IRC 6104(d) regulations state that an organization must provide copies of its three most recent Forms 990 to anyone who requests them, whether in person, by mail, fax, or e-mail.

Form 990 data published by IRS

[edit]The IRS publishes Form 990 data in three main forms. Two are part of the Statistics of Income program:

- The IRS Tax Exempt Organization Search page offers summary information about nonprofits, as well as copies of their tax returns.[20]

- An annual extract of tax-exempt organizational data, which covers selected financial data from filters of Form 990, 990-EZ, and 990-PF, with data available from calendar year 2012 to the most recent year for which filing and statistics compilation is complete.[21] This is also available as a public dataset on Google BigQuery.[22]

- As a public dataset on Amazon S3, hosted in the US East region. The dataset includes index files for each year that list nonprofits that filed Form 990 in that year (possibly for a previous year) along with the identifier for their filing. This identifier can be used to fetch their filed Form 990 as an XML file. Data covers returns filed from 2011 to the present and is regularly updated.[23] This dataset is used by Charity Navigator.[24]

Third-party sources of Form 990

[edit]- Google BigQuery, which has IRS Form 990 data as a public dataset.[22] This is based on statistics published by the IRS from 2012 to the most recent completed year.[21]

- Charity Navigator, which maintains a "990 Decoder" website with over 2.5 million tax returns.[24][25] This is based on forms filed from 2011 to the present, and uploaded by the IRS to Amazon S3.[23]

- Economic Research Institute[26] provides PDF copies of annual returns, signatures not blacked out.

- Foundation Center[27] IRS Form 990 lookup tool; provides PDF copies of annual returns, signatures blacked out.

- Guidestar[28] IRS Form 990's and other information for selection of nonprofits, free and fee based

- NCCS[29] IRS Form 990 search tool and nonprofit organization profiles, signatures blacked out.

- BoardSource Governance requirements[30] in 990.

- Before shutting down in September 2022,[31] Open990[32] distributed timeseries data reports on compensation and financial indicators using fuzzy matching against the AWS dataset.

- The for-profit company Citizen Audit[33] provides PDF copies of annual returns, signatures not blacked out, and full-text searches of 990 forms, but only if you sign up for their services at $350 per year.

- ProPublica's Nonprofit Explorer[34] allows search by an organization's name, a keyword, or city as well as by reported officers or employees. Summary data and full PDFs are freely available for download; no registration required.

History

[edit]Form 990 was first used for the tax year ending in 1941. It was as a two-page form.[19] Organizations were also required to include a schedule with the names and addresses of individuals paid a salary of at least $4,000 during the year and a schedule with the names and addresses of donors who had given at least $4,000 during the year.[19][35]

Form 990 reached four pages including instructions in 1947.[19] Compensation of officers was reported separately on organizations' income statements but organizations were no longer required to include a schedule with the names and addresses of highly compensated individuals.[19] Organizations were required to include a schedule with the names and addresses of donors who had given at least $3,000 during the year.[19]

In 1969, Congress passed a law requiring the reporting of the compensation paid to officers by 501(c)(3) organizations.[19][36] The IRS extended this requirement to all other tax-exempt organizations.[19][37]

In 1976, Form 990 was 6 pages including instructions, with 8 pages for Schedule A.[19] By 2000, Form 990 was six pages, Schedule A was six pages, Schedule B was at least 2 pages, and instructions were 42 pages.[19] The increase in pages was due to use of a larger font size and the inclusion of sections that are only required for certain organizations.[19]

Starting in 2000, political organizations were required to file Form 990.[19]

In June 2007, the IRS released a revised Form 990 that requires significant disclosures on corporate governance and boards of directors. These new disclosures are required for all filers for the 2009 tax year, with more significant reporting requirements for organizations with either revenues exceeding $1 million or assets exceeding $2.5 million.

In 2010, the minimum threshold of when an organization is required to file Form 990 was increased; the minimum annual gross receipts was increased from $100,000 to $200,000 and the minimum assets was increased from $250,000 to $500,000.[12]

With the availability of the internet, access to the Form 990 of an organization has also become easier. Originally Form 990 had to be requested through the IRS. This was changed to allow access to the form directly through the organization, although in some cases organizations refused to provide access.[19]

On July 16, 2018, the IRS announced that only 501(c)(3) organizations, 4947(a)(1) nonexempt charitable trusts, and 6033(d) nonexempt private foundations are required to report the names and addresses of donors on Schedule B. All other tax-exempt organizations will be allowed to omit the names and addresses of donors when completing Schedule B, although they are still required to retain that information and report that information upon request by the IRS. The change in reporting requirements is effective with all tax years ending on or after December 31, 2018.[38] The change did not affect reporting of donors by 527 political organizations.[39] The IRS said that the change in reporting was made in the discretion of the Commissioner of Internal Revenue who had determined that the IRS generally does not use the donors' information, and exclusion of this information from Schedule B would reduce the risk of accidentally releasing confidential information to the public while reducing the organizations' time and cost of preparing Form 990.[40] Some states continue to require disclosure of this information to state agencies.[40] The state of Montana and the state of New Jersey filed a lawsuit stating that the IRS had violated the Administrative Procedure Act by waiving the donor disclosure requirements without allowing the public to comment on the new procedure. A federal judge agreed and reinstated the donor disclosure requirements.[41] On September 6, the IRS issued proposed regulations that would again suspend the requirement for affected organizations to disclose their donors on Schedule B and allow the public to comment on the new procedure in compliance with the Administrative Procedure Act.[42][43] The IRS may finalize the proposed regulations on or after December 9, 2019.[43]

Use for charity evaluation research

[edit]Charity Navigator uses IRS Forms 990[44] to rate charities. In February 2017, Charity Navigator launched the Digitized Form 990 Decoder, a free and open-source software dataset and tools to analyze Form 990 filings. At launch, more than 900,000 forms had been processed.[25][45]

Meanwhile Holden Karnofsky of the nonprofit charity evaluator GiveWell has criticized Form 990 for not providing sufficient information about what a charity does or where it operates.[46] However GiveWell does still use Form 990 to answer some questions when investigating charities.[47]

Data from Form 990 was used by political scientist Sarah Reckhow as an information source for her book Follow the Money: How Foundation Dollars Change Public School Politics. Reckhow expressed concern about the lack of corresponding public data available if philanthropic funders moved away from nonprofits to LLCs such as the Chan Zuckerberg Initiative.[48]

There was a website called Quality 990 that advocated for higher quality Form 990s.[49]

See also

[edit]References

[edit]- ^ "Return of Organization Exempt From Income Tax" (PDF). Internal Revenue Service. Retrieved January 28, 2016.

- ^ "Telling the not-for-profit story through Form 990". Journal of Accountancy. 2016-12-01. Retrieved 2023-12-09.

- ^ Report on Abuse of Charities for Money-Laundering and Tax Evasion (PDF). OECD Centre for Tax Policy and Administration.

- ^ "Instructions for Form 990-EZ" (PDF). Internal Revenue Service. 2015. Retrieved February 3, 2016.

- ^ "Annual Electronic Filing Requirement for Small Exempt Organizations — Form 990-N (e-Postcard)". Internal Revenue Service. Retrieved February 2, 2016.

- ^ "Demystifying the 990-PF". Foundation Center. Retrieved February 3, 2016.

- ^ "Annual exempt organization return: Due date". Labyrinth. Retrieved 2021-01-19.

- ^ IRS (2008-02-04). "Governance and Related Topics - 501(c)(3) Organizations" (PDF). Online.irs.gov. Retrieved 2009-06-05.

- ^ "Pension Protection Act of 2006, Section 1223(b)". Government Printing Office. August 17, 2006.

- ^ "Notice 2011-43: Transitional Relief Under Internal Revenue Code § 6033(j) for Small Organizations". Internal Revenue Bulletin: 2011-25. Internal Revenue Service. June 20, 2011.

- ^ a b c "Form 990 Instructions". Internal Revenue Service. 2018. Retrieved July 19, 2018.

- ^ a b Grace Allison. "The New Form 990 for Tax-Exempt Organizations: Revolution in Progress". 2010. Estate planning. 37(3). p. 14–20.

- ^ 26 U.S. Code § 6033(3). Internal Revenue Service. Legal Information Institute. Cornell University.

- ^ Treasury Regulation Section 1.6033-2(g)(1)(vii).

- ^ "Taxpayer First Act of 2019". United States Congress. July 1, 2019.

- ^ Constantine, George; Lewin, Cindy; Steinberg, Andrew (July 2, 2019). "IRS Reform Law Expands Mandatory Electronic Filing of Nonprofit Tax Returns". Venable LLP.

- ^ "irs.gov ". IRS.gov. pulled May, 17, 2022.

- ^ "Penalties for Failing to Make Forms 990 Publicly Available". IRS. Retrieved 2017-12-07.

- ^ a b c d e f g h i j k l m n Chasin, Cheryl; Kawecki, Debra; Jones, David (2002). "G. Form 990" (PDF). Internal Revenue Service. Archived from the original (PDF) on July 2, 2015. Retrieved January 29, 2016.

- ^ "Tax Exempt Organization Search". Internal Revenue Service. Retrieved 2024-08-30.

- ^ a b "SOI Tax Stats - Annual Extract of Tax-Exempt Organization Financial Data". Internal Revenue Service. Retrieved October 14, 2017.

- ^ a b "IRS Form 990 Data". BigQuery. Retrieved October 14, 2017.

- ^ a b "IRS 990 Filings on AWS". Retrieved October 14, 2017.

- ^ a b "Charity Navigator Publishes Software for Decoding Nonprofit Data". Charity Navigator. February 3, 2017. Retrieved February 10, 2017.

- ^ "Nonprofit Organization Information". Economic Research Institute. Retrieved 2014-05-17.

- ^ "Foundation Center - 990 Finder". Archived from the original on 2013-05-23. Retrieved 2011-08-21.

- ^ "guidestar.org". guidestar.org. 2014-03-06. Retrieved 2014-04-23.

- ^ "nccs.urban.org". nccs.urban.org. 2008-07-15. Retrieved 2014-04-23.

- ^ "Learning Center and Store". BoardSource. Archived from the original on 2012-02-19. Retrieved 2014-03-17.

- ^ Suozzo, Andrea (2022-12-22). "The IRS Hasn't Released Nearly Half a Million Nonprofit Tax Records". ProPublica. Retrieved 2024-05-15.

- ^ "Research people or nonprofits". Open990. Archived from the original on 2022-09-04.

- ^ "Nonprofit Form 990 Search". Citizen Audit. Retrieved 2014-05-18.

- ^ "Nonprofit Explorer". ProPublica. 9 May 2013. Retrieved 2018-10-18.

- ^ "More Income Tax Data: Most Exempt Concerns Must File Information Return". The New York Times. March 24, 1942. p. 34.

- ^ "Internal Revenue Code Section 6033(b)". Internal Revenue Service. Legal Information Institute. Cornell University.

- ^ "Treas. Reg. 1.6033-2(a)(2)(ii)(g). Internal Revenue Service. Legal Information Institute. Cornell University.

- ^ "Revenue Procedure, Rev. Proc. 2018-13". Internal Revenue Service. July 16, 2018.

- ^ Wyland, Michael (July 18, 2018). "Treasury Weakens Donor Disclosure Requirements for Some Nonprofits". Nonprofit Quarterly.

- ^ a b Parks, Zachary G. (July 18, 2018). "IRS Announces Major Change To Nonprofit Donor Disclosure Requirements". The National Law Review.

- ^ Lewin, Cynthia M.; Norton, Lawrence H. (August 1, 2019). "Donor Disclosure Rules for Nonprofit Tax Returns Overturned by Federal Court". Venable LLP.

- ^ Norton, Lawrence H.; Lewin, Cynthia M. (September 11, 2019). "IRS Issues Proposed Regulations on Nonprofit Donor Disclosure Rules". Venable LLP.

- ^ a b "Proposed Reg. 102508–16: Guidance Under Section 6033 Regarding the Reporting Requirements of Exempt Organizations". Internal Revenue Service. Federal Register. Vol. 84. No. 175. p. 47447–47454. December 10, 2019.

- ^ "FAQ for Donors". Charity Navigator. Retrieved 2014-04-23.

- ^ Miniutti, Sandra (February 3, 2017). "First Open Source Release of Code that Reads Digitized IRS Form 990 Data". Charity Navigator Blog. Retrieved February 10, 2017.

- ^ Karnofsky, Holden (May 23, 2007). "Don't talk to me about the Form 990". The GiveWell Blog. Retrieved January 28, 2016.

- ^ "Guide to GiveWell's financial metrics". GiveWell. Retrieved January 28, 2016.

- ^ Reckhow, Sarah (January 26, 2017). "Philanthropic Data And The Rise Of LLCs; Or, What Happens When Scholars Can No Longer Follow The Money". HistPhil. Retrieved April 25, 2018.

- ^ "Background for Quality 990 Efforts". Archived from the original on May 15, 2008. Retrieved January 29, 2016.